There’s no quick temporary for defining insurance. Insurance coverage is a self-protective measure employed to circumvent possible risks for the future. It’s a legal contract removed between a person and an insurer. This contract would safeguard a person from possible risks or losses through financial means, and offers a means for individuals and communities to higher handle a number of daily life’s risks. The above mentioned pointed out contacts of insurance are known as insurance plans, and therefore are supplied by insurance providers. The insurance coverage companies would charge a habitual agreed amount in the insured, that is compensated to the insured either fully or perhaps in part within the situation of the legitimate claim against the insurer in regards to condition established within the insurance plan. This regular amount billed by the insurer is generally known as an insurance coverage premium.

At occasions in existence, it’s just impossible to prevent loss. For example, individuals can become sick. They might even die of illnesses of accidents, or their properties or any other property might suffer damage or thievery. In most these examples, people involved would incur loss or damage. Insurance coverage is a means by which ordinary individuals can fully financially insure which should such conditions present itself, losing would then not affect the caliber of existence or wellness from the insured.

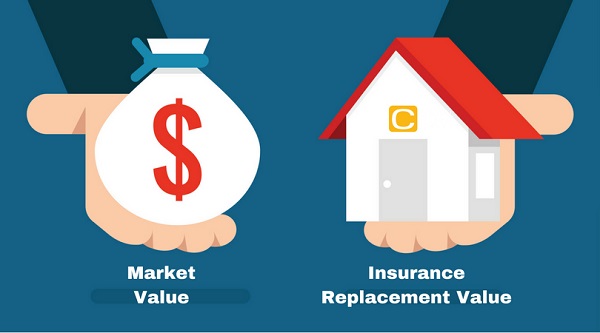

There are numerous insurance products in the marketplace geared at meeting the requirements of various clients. Existence insurance plans would insure the existence from the insured. Insurance providers would shell out an agreed amount of cash towards the insured’s beneficiaries in case of his dying. The payout will be compensated towards the beneficiaries in both a lump sum payment, or perhaps in an award. A narrow description of health care insurance is the insurance plan pays the quantity towards the person that is insured for his health purposes. The quantity would cover the price of treatment. You will find essentially 2 kinds of disability insurance. The first being easy disability insurance and yet another being total disability insurance. In case of simple disability, financial support could be provided monthly by the insurer towards the insured should he be not able to operate any longer because of illness or perhaps an injuries. Total disability insurance would payout if an individual becomes permanently disabled. General insurance entails vehicle insurance, home, property and business insurance.

There are specific factors that influence the payout of insurance claims. These stipulate that there must be an absolute loss which has occurred. The incident that’s the reason for the claim ought to be incidental and appear to have been past the charge of the insured. The probability of loss and also the expenditure of recompense ought to be assessable.