Today’s companies need insurance for several things, from liability to covering business vehicles plus much more. There’s frequently plenty of confusion in what insurance your organization will need, especially as growing figures of companies use their properties for office. This can be a handy report on the main types of insurance you’ll demand for business, and why you will need that insurance to get effective, and compliant along with your company laws and regulations and rules.

1. General Insurance

No matter your organization, you will need insurance, even if your small business is based at home. This insurance provides defence and damages in the event you, your products or services and/or services or possibly the employees be a part of an accidents that creates (or allegedly causes) bodily injuries or property damage.

2. Professional Insurance

Frequently referred to as “Errors & Omissions Insurance,” this insurance plan protects your organization in situation of failure to, or perhaps the incorrectly rendering, of guaranteed services. It is really an important insurance to own because, essentially, people make a few mistakes. If both you and your company don’t do whatever they certain to complete, this insurance might help purchase defence and/or damages, aiding you be careful without endangering the financial way ahead for your business.

Realize that this insurance policies are generally not offered generally insurance plans.

3. Property Insurance

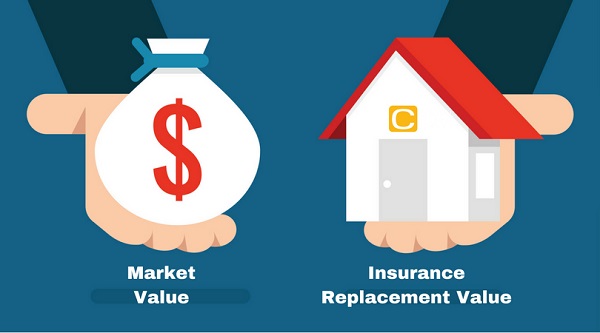

Although not mandatory, in the event you have a very building, equipment, computers or almost anything connected together with your company, you have to consider property insurance. The insurance plan will safeguard you in situation of the tragedy, as being a fire, and against things like vandalism as well as other crimes.

Another part of this insurance policies are insufficient earning and/or business interruption insurance, which will shell out out when you overcome the wedding that interrupted your normal business operations.

4. Commercial Vehicle Insurance

In situation your organization has vehicles, they must be insured with the business, whether you can use them by employees or yourself. As lengthy as individuals vehicles are employed to carry people, products or equipment, they ought to be insured below your business getting an industrial car insurance plan. The insurance policy will safeguard you inside the illustration showing damage or collisions.

In situation the employees use their particular vehicles for work, you’ll still need a policy that protects the organization when tips over when the vehicle continues to be useful for commercial purposes. This can be referred to as “non-owned car insurance.”

5. Workers Compensation

When employees or proprietors are hurt at the office, workers compensation makes sure that they have an earnings to assist them through their own health problems and days off for surgical treatments. The insurance policy entails employees quit their to file a lawsuit their company, that is required for business proprietors. Workers compensation insurance policies are mandatory from time to time, which means you should know the legal needs in your neighborhood with this particular insurance.

6. Company company directors and Officials Insurance

Using this insurance, your business’ leaders will probably be resistant to their actions that may alter the earnings, profitability or operations of the organization. Essentially, in situation your organization company directors or officials finish inside a legitimate situation stemming utilizing their actions, this insurance can cover costs connected with defence and, sometimes, damages brought on by individuals actions.

7. Homeowner’s Insurance

In the event you run your house-based business, you will need this insurance. It may be mandatory according to your mortgage but it is crucial that you inform insurance companies if you are operating a home-based business. Without any proper insurance, certain occurrences may not be incorporated inside your standard insurance as it is connected by having an unreported business. Contact insurance providers before beginning operating a home-based business to make certain you’re compliant, and covered.